The Conditions for Buying a House in Dubai Explained

Investing in real estate in Dubai is a strategic move for international investors, governed by a clear and secure legal framework. Non-residents are allowed to acquire property in specific “Freehold” areas, which guarantee full ownership rights. To navigate this process successfully, the assistance of a RERA-certified real estate agent is essential to ensure the transaction’s compliance. Additionally, an investment of at least 750,000 AED (approximately €188,000) makes you eligible for a two-year residence visa, a major advantage of this dynamic market.

Dubai, at the heart of the United Arab Emirates (UAE), has become a key financial hub. Its dynamic real estate market particularly attracts investors looking to optimize their assets. While acquiring a prime property is accessible, it is governed by strict rules. Understanding each condition is therefore essential. The local legal framework offers unique advantages, such as full ownership and obtaining a residence visa. For a non-resident, navigating these procedures without expert guidance can be complex. Our role is to turn this complexity into a clear opportunity, securing your purchase and guiding you toward obtaining your visa.

Why Dubai Appeals to International Investors

Dubai has established itself as a stronghold for foreign investors, and this success is built on solid financial pillars. The main appeal lies in a tax framework with no income tax, allowing investors to maximize their return on investment. Additionally, the market offers some of the highest gross rental yields in the world, ranging between 7% and 12% per year. This profitability, combined with strict economic security, explains why acquiring a property is a strategic decision.

Investor confidence is a key indicator. At Guardians Prime, our management of a portfolio exceeding 15 billion AED in real estate value confirms this. As experts, our role is to secure every step of your acquisition. We guide you toward the asset that matches your objectives, whether it involves portfolio diversification or stable rental income. Choosing the right property is fundamental for any international investor.

Key Conditions for Buying Real Estate as a Foreigner

For an international investor, acquiring a property in Dubai is a structured and secure process. Far from being a complex journey, it is based on a clear legal framework. To ensure the protection of your investment, it is essential to master the three pillars that define every transaction: your legal status, the property’s location, and the financial framework of the operation. Each step is designed to provide maximum transparency, turning an important decision into a guided and fully controlled process.

Condition 1: The Buyer’s Legal Status

Dubai’s real estate legal framework is a cornerstone of the security offered to investors. It clearly answers a fundamental question: can a foreigner buy property? The answer is an unequivocal yes. Whether you are a resident or not in the Emirates, your status allows you to acquire real estate. This accessibility is the cornerstone of the emirate’s appeal. For investors who are not citizens of a Gulf Cooperation Council (GCC) member country, this authorization is limited to designated areas, known as “Freehold,” where you enjoy full ownership.

Condition 2: Ownership Rights in Designated Areas (Freehold)

For a foreign investor, acquiring property in Dubai is conditioned by the legal status of the area. The full ownership regime, or Freehold, grants you absolute and perpetual ownership of the property and the land on which it is built. It differs from Leasehold, which is similar to a very long-term lease (typically 99 years) without transferring land ownership, thus limiting your property rights.

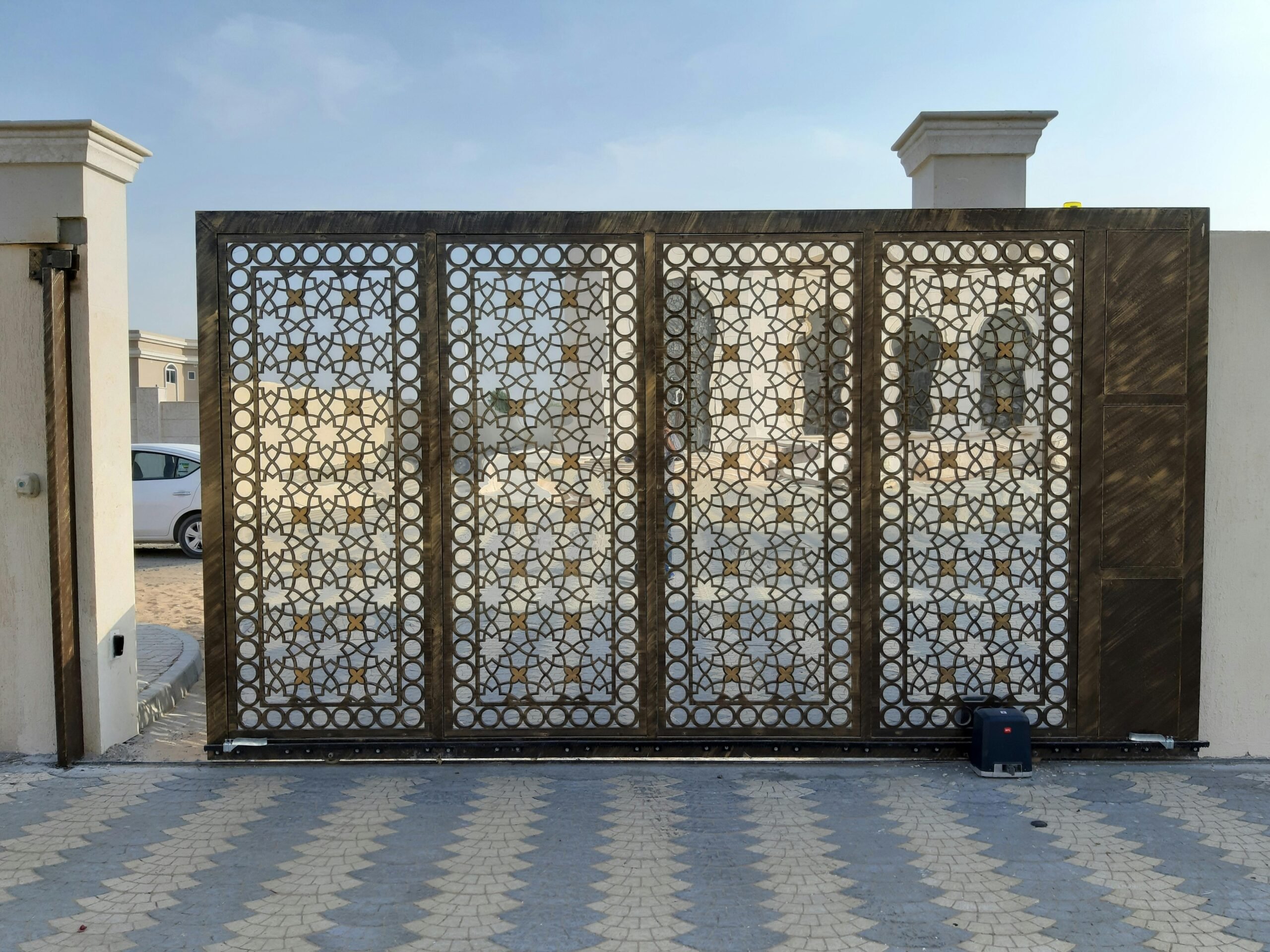

This secure legal framework applies to specifically designated areas that have become emblematic of Dubai’s prestige: Dubai Marina, Downtown Dubai, and Palm Jumeirah. Understanding this distinction is a prerequisite for ensuring the security of your investment. It is a cornerstone of our legal support, ensuring that every transaction strictly complies with the legal framework for complete peace of mind.

Condition 3: The Financial Framework and Fees to Anticipate

To secure your investment, a complete understanding of the financial framework is essential. The main fee to anticipate is that of the Dubai Land Department (DLD), which amounts to 4% of the property value. Agency fees are 0% for the buyer on a new property, as they are covered by the developer, and 2% on the secondary market. Beyond these costs, structured financing solutions are available. For non-residents, local banks can provide financing of 50% to 60% of the property price. Additionally, many developers offer interest-free direct payment plans, a flexible option to spread your investment. Our expert advisory role is to guide you toward the financial structure best suited to your needs, protecting your interests at every stage.

The Secure Buying Process, Step by Step

Understanding each step of the buying process in Dubai is the key to a successful investment. Far from being complex, the process is structured to protect the buyer. Our role, as your dedicated real estate agent, is to manage this procedure for you, ensuring complete transparency and security at every milestone. Every property we offer is pre-validated to ensure compliance with legal requirements for an international buyer.

- Selecting the Property With a RERA-Certified Real Estate Agent

The first step is to identify the ideal property with your Real Estate Regulatory Agency (RERA)-certified agent. Our experts present opportunities aligned with your financial goals and verify that the property is located in an area allowing full ownership. - Signing the Memorandum of Understanding (MoU)

Once the property is selected, we formalize the agreement between you and the seller through a Memorandum of Understanding (MoU). This document binds both parties and sets the terms of the transaction. Guardians Prime provides legal assistance to review this contract and protect your interests. - Obtaining the No Objection Certificate (NOC)

We handle the liaison with the developer to obtain the No Objection Certificate (NOC). This document is crucial: it certifies that there are no debts or encumbrances on the property, an essential condition before the transfer of ownership. - Property Transfer at the Dubai Land Department (DLD)

The final step takes place at the Dubai Land Department (DLD), the government authority that formalizes your ownership status. We assist you throughout the DLD registration process, which grants you full ownership and makes you eligible for a residence visa.

This secure process guarantees that your investment is protected by a robust legal framework. Our real estate agent oversees every detail to make your property acquisition a smooth and efficient experience.

| Type of Fees | Amount / Percentage | Paid By |

| DLD Registration Fees | 4% of the property value | The Buyer |

| Commission (Secondary Market) | 2% of the property value | The Buyer |

| Commission (New / Off-Plan) | 0% (paid by the developer) | The Developer |

| No Objection Certificate (NOC) Fees | Variable (500 to 5,000 AED / approx. €125 to €1,250) | The Buyer |

Obtaining a Residence Visa Through Real Estate Investment

Acquiring a property in Dubai represents a direct and secure path to obtaining a residence visa. This process is governed by clear thresholds. Purchasing a property with a minimum value of 750,000 AED (approximately €188,000) makes you eligible for a two-year residence visa. This authorization is renewable, allowing you to maintain your status as long as you retain the property.

For investors seeking long-term stability, acquiring an asset worth more than 2 million AED (approximately €502,000) opens the door to the prestigious Golden Visa. This ten-year residence permit is a major advantage. Our role goes beyond a simple transaction: we act as your guardian. Guardians Prime provides comprehensive support in administrative procedures to secure your visa. We guide each investor to ensure their project is realized with complete peace of mind.

The Role of Your Real Estate Agent: A Guardian for Your Investment

Navigating the Dubai market requires the involvement of a RERA-certified real estate agent. This is an essential measure to protect your capital. At Guardians Prime Real Estate L.L.C., we embody this role of Guardian. Our mission is to secure the acquisition of your property, whether it is to obtain full ownership or a residence visa. Each investor is guided through a secure process, from property selection to property management. We provide expert advice, legal assistance, and negotiate on your behalf. With a 98% client satisfaction rate, we honor our mission as Guardians.

Your Real Estate Project in Dubai: An Informed Decision

Dubai’s real estate market offers a structured legal framework designed to protect investors. The conditions are transparent, from full ownership acquisition to obtaining a residence visa. However, the expertise of a real estate agent is crucial to secure the purchase. Choosing your agent defines the security of your project. Guardians Prime Real Estate L.L.C. acts as your guardian, ensuring that the acquisition of your property is perfectly managed. Receive tailored expert advice and turn your project into a secure success.

FAQ

Yes, a foreigner can absolutely own property in Dubai. The local law has been specifically designed to attract international investors. Acquisition is possible in designated “freehold” areas, where you obtain full ownership of the property, including the land. This approach, regulated by the Dubai Land Department (DLD), ensures complete legal security for your investment.

Absolutely. Real estate investment is a direct path to obtaining a residence visa. The thresholds are clear: a property valued at 750,000 AED (approximately €188,000) makes you eligible for a 2-year residence visa, which is renewable. For an investment exceeding 2 million AED (approximately €502,000), you can obtain the 10-year Golden Visa.

Financial transparency is paramount. The main fees to anticipate are:

Dubai Land Department (DLD) Fees – these amount to 4% of the property value and are the responsibility of the buyer for the property title registration.

Real Estate Agent Commission – for a new off-plan property, the commission is 0% for the buyer, as it is paid by the developer. For a property on the secondary market, it is 2%.

Understanding the nature of your ownership rights is essential. In “freehold” areas, a foreigner acquires perpetual full ownership of the property and the associated land. This is the most complete and sought-after form. In contrast, “leasehold” grants the right to use a property for a long term but does not confer ownership of the land. An expert agent guides you toward the solution that matches your objectives.